The Increasing Attention of This Tiger Cub — Indonesia’s Growing Relevance In The Global South

During the 2023 BRICS summit in Johannesburg, Indonesia applied for membership. The nation’s candidacy was supported by all BRICS leaders in August 2023. However, Indonesia opted to formally join the organisation, only once the nation’s 2024 elections concluded and a new government was formed.

Following the beginning of Brazil’s chairmanship of BRICS this year, Indonesia has now officially become a full-member of the organisation on January 7th, bringing the group up to 10 full-members (Brazil, Russia, India, China, South Africa, Egypt, Ethiopia, Iran, United Arab Emirates). Moreover, this adds to the number of other organisation memberships the country holds (RCEP, G20, ASEAN, APEC, Non-Aligned Movement, D-8, MIKTA, East Asia Summit and Organisation of Islamic Cooperation).

This marks the significance of Indonesia’s increasing presence in the Global South. Indonesia has a population of 284 million, making it the fourth largest globally, the largest economy in South East Asia and the 16th largest globally (as the nation’s GDP stands at $1 trillion).

Key Definitions:

Indonesia is one of the five tiger cub economies, which refers to five newly industrialised nations in South East Asia. Alongside Indonesia, this group consists of Malaysia, The Philippines, Thailand and Vietnam. These nations are trying to chart a similar path of economic development as their East Asian neighbours (Japan, China, South Korea, Singapore, Hong Kong and Taiwan).

This would be done by implementing state-led policies (coordination between both government and the private sector), attract FDI (foreign direct investment) and diversifying their economies from relying solely on their natural resources. This would be in order for them to develop other sectors of their economies to secure long — term economic growth. Indonesia is predicted to become a major economy over the next few decades.

Domestic Economy:

Figure 1 - Indonesia's GDP Nominal growth between 1980-2024 (IMF, 2024)

Since the 2020 Covid crisis, Indonesia’s economy has rebounded , with inflation levels going down considerably. Indonesia’s GDP growth is projected to average 5.1% (figure 1), between 2025–2026. According to an World Bank report (2024), consumption is expected to be the engine drive for new growth, supported by a pick-up in public consumption. Especially, as new social spending programs from the newly elected government begin to take effect, alongside the anticipated increase in private investment.

The nation’s inflation level is expected to remain stable, averaging 3% in 2024 and 2.9% thereafter, well within the Bank of Indonesia’s target band. However, it will be facing upward pressure from food an energy prices. Alongside increased social spending and public investment, the fiscal deficit is expected to be higher but remain within the 3% rule.

Indonesia’s external position is expected to remain challenging due to a sluggish recovery in global trade, due to external factors (protectionist measures, sanctions and supply chains disruptions). The current account deficit is projected to gradually widen and reach 1.6% of GDP by 2026, as lower commodity prices and global uncertainty hamper exports (World Bank, 2024).

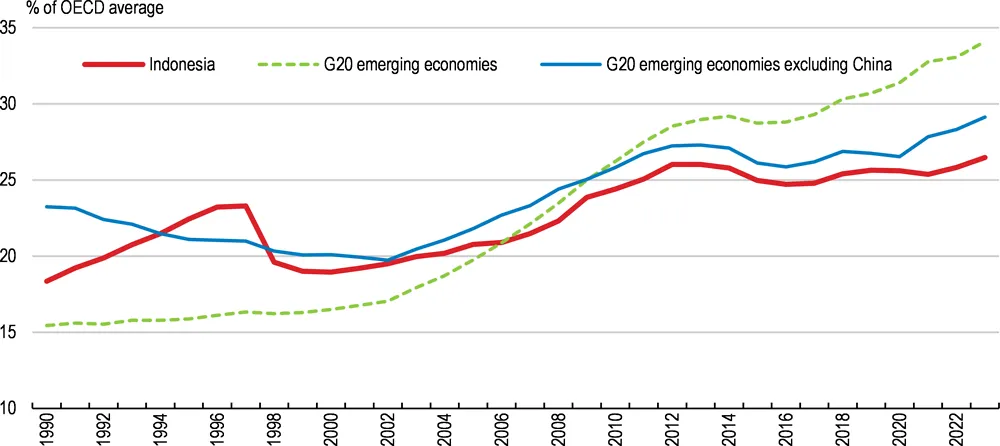

Figure 2 - GDP Per Capita (OECD, 2024)

Real income per capita has more than doubled over the past quarter of century, and extreme poverty has declined. However, over the past decade economic growth has not been sufficient to bring further economic convergence in GDP per capita (Figure 2), highlighting slow labour productivity growth. This highlights the importance of Indonesia’s domestic and foreign policy of integrating the nation into global supply chains.

Moreover, the unemployment rate has decreased from 7.1% in mid-2020, at the peak of the pandemic, to 4.9% in mid-2024, below the pre-pandemic prevailing range of 5–5.5% (OCED, 2024).Indonesia continues to provide government support towards its mining sector, manufacturing electronic components and its energy sector. As the government views these sectors will continue to require and attract FDI to achieve long-term economic growth.

Mining Sector — November 27th 2024: The National Development Planning Ministry (Bappenas) has made industrialisation and downstreaming as central policies to increase the industry’s contribution to Indonesia’s gross domestic product (GDP).

- “In the economic transformation agenda, industrialisation and downstreaming are central policies to reverse the contribution of the industrial sector to GDP to increase,” the agency’s deputy minister, Febrian Alphyanto Ruddyard, stated here on Tuesday.

- Based on Indonesia’s natural resources, nickel is the commodity with the largest ore reserves in the world, with a total of 5.24 billion tons, 49.7 million tons of the world’s largest Crude Palm Oil (CPO) production, 3.13 billion tons of bauxite reserves, and 9.2 million tons of the second-largest seaweed production in the world.

- Downstreaming of priority commodities is considered to be the key to increasing added value with the potential for an additional GDP of USD165 billion, based on Bappenas’ data.

Electronic Component Manufacturing — January 10th 2025: Indonesia is maintaining its ban on the sale of the iPhone 16 in the country, despite an investment commitment from Apple this week to build a $1 billion Airtag manufacturing facility in Batam that would be operational by early 2026.

- In 2024, the nation’s industry ministry blocked the sale of the latest iPhone model because it did not meet a requirement that electronics such as smartphones and tablets sold domestically contain at least 35% locally made parts. Google’s Pixel phones were also barred in Indonesia for the same reason.

- Apple’s vice president of global government affairs Nick Ammann was reportedly in Jakarta this week to meet with Indonesian ministers in an effort to persuade the government to lift its ban on the sale of the iPhone 16. Agus was among the government officials that the Apple executive met during his visit.

- The Indonesian government has been calling on Apple to increase its investment in the country, specifically seeking manufacturing investments on par with what the tech giant has planned in other Southeast Asian countries.Apple does not have a manufacturing facility in the country. But, it runs four local developer academies to train students and engineers in app development.

- Speaking to local media on Wednesday, Agus pointed out that the proposed Airtag factory in Batam could not be the ticket for the iPhone 16 to enter the Indonesian market, as the device produced could not be considered an iPhone part.“It is not directly related to the manufacturing process of mobile phones, handheld computers, and tablets in the provisions to obtain Domestic Component Level (TKDN) certification,” he said.

Energy Sector — January 7th 2025: The members of the Indonesian Petroleum Association (IPA) have responded positively to the new Minister of Energy and Mineral Resources (ESDM) Regulation (Permen) №16/2024 on the Implementation of Carbon Storage Activities issued on December 24, 2024.

- This regulation complements the legal framework related to Carbon Capture and Storage (CCS) which was previously regulated in Ministerial Regulation №2/2023 and Presidential Regulation (Perpres) №14/2024.

- Executive Director of IPA, Marjolijn Wajong, said this new regulation is an important milestone that provides legal certainty for industry players.

- CCS is considered to have great potential in helping Indonesia achieve its Net Zero Emission (NZE) and Nationally Determined Contributions (NDC) targets. This technology provides decarbonization solutions for various industrial sectors, including manufacturing, power generation, refineries, petrochemicals, steel, and cement. In addition, CCS also provides opportunities for economic growth through job creation and investment in clean technology.

- Indonesia has significant potential carbon storage capacity, namely up to 8 gigatons of carbon dioxide (CO2) in depleted oil and gas reservoirs and 400 gigatons in salty aquifers. According to the ESDM ministry, this potential can increase Indonesia’s attractiveness as a regional carbon storage center, in line with Indonesia’s commitment at COP29 to become a leader in CCS initiatives in the region.

- The Indonesian government is also actively establishing regional cooperation to accelerate the development of CCS. One of the strategic measures taken is the signing of a Letter of Intent (LoI) between Indonesia and Singapore for cross-border collaboration in CCS, which allows for the transportation and storage of CO2 between the two countries. In addition, Indonesia is also exploring similar cooperation with Japan and South Korea to strengthen its position as a CCS hub in Southeast Asia.

Foreign Policy:

In the case of Indonesia’s foreign policy, the nation has recently begun embarking on expanding ties with Africa, improving defence cooperation agreements and dealing with trade disputes from WTO (World Trade Organisation).

Defence Cooperation deals — December 19th 2024: Indonesia recently embarked on simultaneous military exercises with two nations on opposite ends of the geopolitical spectrum: Russia and Australia. These drills, held under the leadership of President Prabowo Subianto, underscore Indonesia’s ambition to assert itself as a neutral yet strategic player in an increasingly polarised world.

- For the first time in its history, Indonesia conducted naval exercises with Russia, signifying deepening defence relations with Moscow. Running parallel to this, Indonesia engaged in its largest joint military drill with Australia in years, showcasing its enduring partnership with Western counterparts.

- The Orruda Joint Exercise, featuring naval operations in Surabaya and the Java Sea, is viewed as a reflection of Prabowo’s commitment to strengthening ties with Moscow. This exercise stems from an agreement reached during the 2018 Navy-to-Navy Talks (NTNT) between the Indonesian and Russian navies. Despite the four-year gap since the agreement, the drills materialised only after Prabowo assumed office in October 2024.

- Indonesia’s defence ties with Russia remains significant, as Jakarta continues to depend on Russian-made weapon systems for its military capabilities. From Su-30 fighter jets and BMP tanks to small arms, Indonesia relies heavily on Russia and its allies, such as Belarus, for a steady supply of spare parts and ammunition. Many of these critical components were not included in previous joint-manufacturing agreements with Russia, underscoring the importance of this partnership.

- On the other hand, the joint drills with Australia underscore Jakarta’s dedication to fostering regional stability and strengthening collaboration with Western partners. Dubbed Exercise Keris Woomera, the initiative involves more than 2,000 personnel participating in air, maritime, and disaster relief operations. This milestone follows the landmark signing of the Australia-Indonesia Defence Cooperation Agreement in August 2024, a historic achievement for both nations. It also demonstrates Indonesia’s capability to sustain strong and constructive relations with its regional neighbours.

- Indonesia’s foreign policy is mainly rooted in the philosophy of bebas-aktif (independent and active), a doctrine that champions neutrality while enabling proactive engagement. Under Prabowo’s administration, this approach is being reinvigorated with a pragmatic twist: befriending all nations to maximise opportunities while avoiding entanglement in rivalries. As Prabowo succinctly put it, Indonesia strives for “a thousand friends, too few; one enemy, too many.”

Indonesia expanding ties with Africa — 5th September 2024: The Indonesia-Africa Forum (IAF) 2024 concluded with the signing of 32 new business partnerships, according to the Foreign Ministry, including nine in the health sector, six in renewable energy and four in strategic industries.

- The energy and food sectors were the major contributors in terms of deal value, the ministry said, with the former accounting for agreements totalling US$1.5 billion, including one involving Pertamina. In that deal, the state-owned oil and gas holding company acquired a 60 percent stake in Wentworth Resources, operator of the Mnazi Bay gas block in Tanzania. Pertamina also signed a contract with the Petroleum Training and Education Fund (Petrofund), established by the Namibian government.

- Meanwhile, state electricity company PLN signed deals with the Tanzania Geothermal Development Company (TGDC) and the government-owned Tanzania Electric Supply Company Limited (Tanesco) to develop 225 megawatts of geothermal power in Luhoi, Natron and Ngozi.

- Aside from state-owned enterprises (SOEs), private companies also signed energy deals, such as the one between Jakarta-based PT Energi Mega Persada and Mbombela-headquartered Vutomi Energy to build independent power plants (IPPs) with a combined capacity of 500 MWs in South Africa. Deputy Foreign Minister Pahala Mansury said on Monday that the forum resulted in food sector deals totaling $1.2 billion, particularly in fertiliser production.

- Local ammonia producer PT Essa Industries signed a memorandum of understanding (MoU) with the Tanzania Petroleum Development Corporation (TPDC), the Tanzania Fertilizer Regulatory Authority (TFRA) and the Tanzania Investment Center (TIC) to build a factory in Tanzania to produce ammonia for manufacturing fertilizer. PT Saputra Global Harvest meanwhile signed a sales agreement to provide coal fertiliser machines to Nigeria.

- Strategic industries, including the defence and aerospace sectors, contributed deals worth $173.5 million during the IAF, including an agreement for state-owned weapons manufacturer PT Pindad to supply its products to South Africa’s Rheinmetall Denel Munition.

- The health sector contributed $94.1 million in agreements during the forum, including deals between state-owned pharmaceutical firm Biofarma and several African countries. These include an MoU with Natpharm to sell Biofarma products in Zimbabwe and sales agreements with Uganda, as well as deals with the Nigerian government on a tetanus-diphtheria vaccine. Biofarma firm also inked deals on technology transfers and employee training with Ghana’s Atlantic Life sciences and Kenya’s Biovax Institute.

WTO dispute between Indonesia and the European Union — January 12th 2025: The World Trade Organisation experts on Friday largely upheld European Union restrictions on use of palm oil in biofuels following a complaint by Indonesia.

- Indonesia, the world’s leading producer of palm oil, in 2019 requested an expert panel review of the EU restrictions. The dispute panel has “found largely in favour of the European Union”, a Geneva-based trade official told AFP.

- “However, the panel found certain deficiencies in how the challenged measures had been prepared, published and administered,” the official added.

- The dispute concerns the EU Renewable Energy Directive of 2018 (RED II) which limited the eligibility of crop-based biofuels to count towards member states’ renewable energy targets, and phased out the eligibility of palm oil-based biofuels altogether by 2030.

- The EU has deemed that palm oil production is not sustainable.A WTO dispute panel issued a similar ruling on the EU restrictions last year, in a complaint lodged by Malaysia.

Culture:

In a fast changing multipolar world, the Indonesian government has been very active to preserve its traditional cultural events and sites. Especially, as a nation undergoes rapid development, this can potentially result in the erosion of its local traditions, which end up replaced by foreign competition.

Reog Ponorogo achieves UNESCO status — 4th December 2024: Reog Ponorogo has been officially inscribed as an Intangible Cultural Heritage (ICH) by UNESCO during the 19th session of the Intergovernmental Committee for the Safeguarding of the Intangible Cultural Heritage, held in Paraguay on Tuesday.

- The decision follows a proposal submitted by the Indonesian government through the Cultural Affairs Ministry to include Reog Ponorogo in UNESCO’s ICH list. This recognition marks Indonesia’s 14th cultural heritage entry on UNESCO’s prestigious roster.

- Minister Fadli Zon said he was proud of the achievement, describing it as a milestone in the preservation of Indonesia’s cultural arts. “Reog Ponorogo is not just a performance but a reflection of the identity, spirit, and resilience of the people of Ponorogo,” Fadli said.

- Originating from Ponorogo Regency in East Java, Reog Ponorogo is a traditional performance art that blends dance, music, and mythology. It symbolises cooperation, evident in its creative process, from mask-making to the collaboration between artists, craftsmen, and the local community.

- Fadli said the government is dedicated to advancing national culture within a global context while ensuring the freedom to preserve and develop cultural values, as mandated by Article 32, Paragraph 1 of the Indonesian Constitution.

- The UNESCO recognition is regarded as an important for Indonesia to boost efforts in preserving traditional cultures rooted in local values and the spirit of togetherness. To sustain Reog Ponorogo, the government and local communities have undertaken various initiatives, including documentation, promotion, and integration into formal and non-formal education.

Critique:

Based on all three topics covered in the case of Indonesia: domestic economy, foreign policy and culture, each section has highlighted how Indonesia is increasingly establishing itself in the global south. Moreover, Indonesia is on the cusp of becoming a major economic (tiger) and global power.